Kasyno HotSlots promocje i bonusy Listopad 2024

Kasyno HotSlots promocje i bonusy Listopad 2024 Jeśli uda nam

If you are using Bitcoin for purchases, the easiest way to do that is through debit-card-type transactions. You can also use these debit cards to withdraw cash, just like at an ATM. https://assisesletrot2020.com/horse-racing-about-all-kinds-of-horse-racing/ Converting cryptocurrency to cash is also possible using banking accounts or peer-to-peer transactions.

What is cryptocurrency? Cryptocurrency is best thought of as digital currency (it only exists on computers). It is transferred between peers (there is no middleman like a bank). Transactions are recorded on a digital public ledger (called a “blockchain”). Transaction data and the ledger are encrypted using cryptography (which is why it is called “crypto” “currency”). It is decentralized, meaning it is controlled by users and computer algorithms and not a central government. It is distributed, meaning the blockchain is hosted on many computers across the globe. Meanwhile, cryptocurrencies are traded on online cryptocurrency exchanges, like stock exchanges. Bitcoin (commonly traded under the symbol BTC) is one of many cryptocurrencies; other popular cryptocurrencies include “Ether (ETH)” and various altcoins that serve different purposes within the ecosystem.

Cryptocurrency works a lot like bank credit on a debit card. In both cases, a complex system that issues currency and records transactions and balances works behind the scenes to allow people to send and receive currency electronically. Likewise, just like with banking, online platforms can be used to manage accounts and move balances. The main difference between cryptocurrency and bank credit is that instead of banks and governments issuing the currency and keeping ledgers, an algorithm does.

Step 4: This is the peak of investment, and might take you years to come to. You can then start looking into higher risk investments like DeFi Protocols. The latter are pretty insane mechanisms that can return more than 100% APY in farms, pools, but note that these liquidity pools are subject to this risk called impermanent loss. Allocate 1-5% of what you’re willing to risk. E.g, pancakeswap, pancakebunny, apeswap are some protocols you can look into!

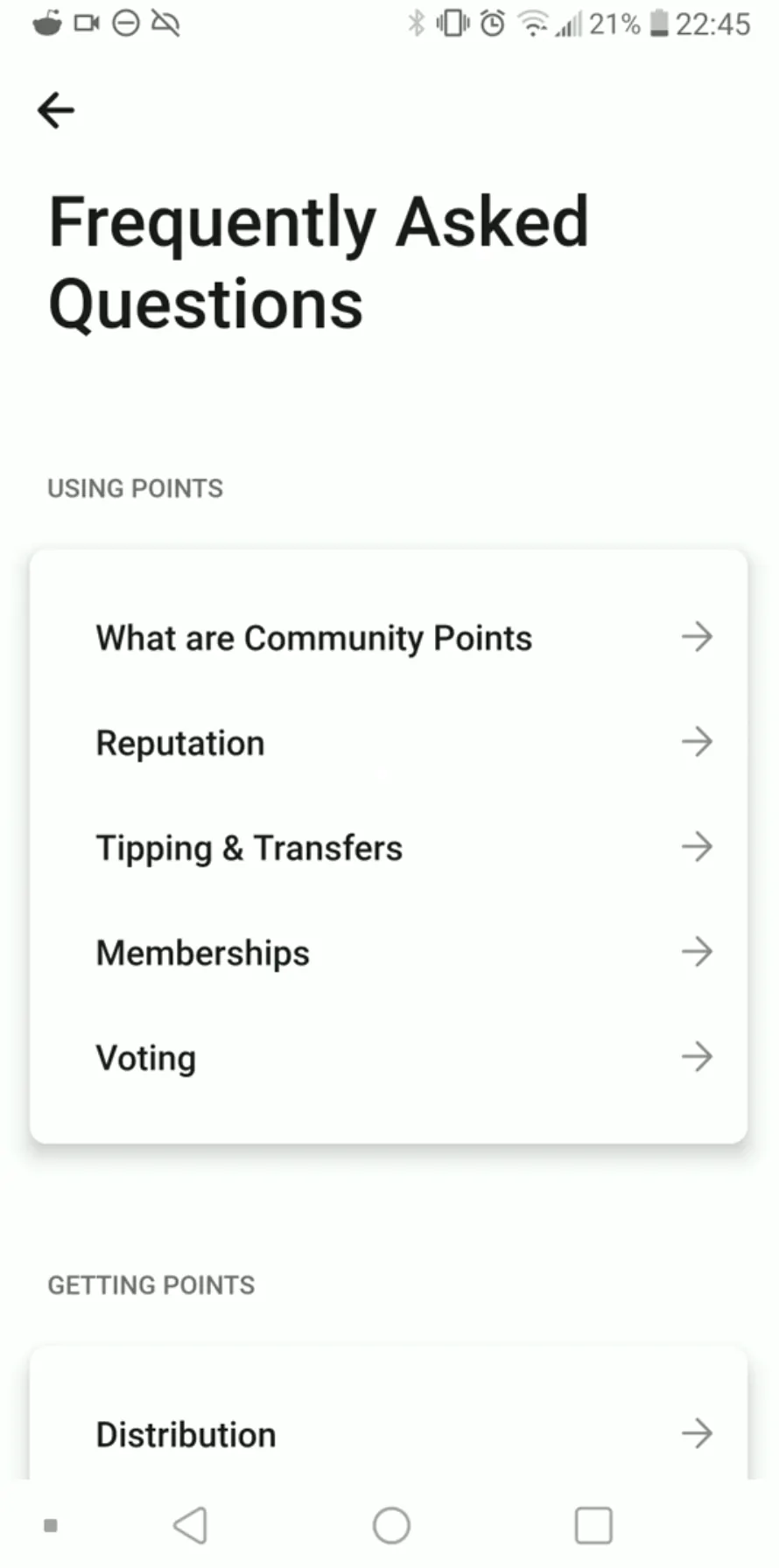

Moons have a limited supply of 250,000,000 – that of which 11 rounds have been distributed already. Just think that in the 1st distribution, people were making upwards of 7 Moons per karma. Now, we’re making a fraction of that. How many will we be receiving by the 40th round? I couldn’t guess, but maybe I’ll be in 69th place by that point – heh.

Last piece of advice: always be cautious and double-check everything. Keep your devices malware-free, and don’t click on anything suspicious (such as emails from « Binnance », crazy bonus links from « Coimbase », etc.). If exchange supports anti phishing code (Binance, Kucoin and others do) be sure to check it!

Your **private key** is a string of 64 characters that can be generated from a 12-word seed phrase. It basically serves as the password of your account. It is used to sign transactions and to prove that you own the related public key.

There’s an old saying in Tennessee that says: ** »Not your keys, not your coins. »** What it actually means is that if you keep your cryptocurrencies on an exchange (such as Coinbase, Binance or Kraken), you don’t actually own those coins, because you don’t have the keys to the related wallet. You gain access to those wallets by logging into these exchanges, but your account can – theoretically – be deleted in the blink of an eye, or the exchange can get hacked, attacked, etc. And with it, your funds can disappear forever. If you want to learn more about this, make sure to look up Mt. Gox’s hacking. It is an unfortunate event, but one that puts you on guard.

However, custodial wallets come with risks. Because a third party manages your crypto, they also control your crypto keys. This means that if the company goes out of business or is hacked, your crypto could be at risk.

The implication here is that users must trust the service provider to securely store their tokens and implement strong security measures to prevent unauthorised access. These measures include two-factor authentication (2FA), email confirmation, and biometric authentication, such as facial recognition or fingerprint verification. Many exchanges will not allow a user to make transactions until these security measures are properly set up.

Cryptocurrency wallets store users’ public and private keys while providing an easy-to-use interface to manage crypto balances. They also support cryptocurrency transfers through the blockchain. Some wallets even allow users to perform certain actions with their crypto assets, such as buying and selling or interacting with decentralised applications (dapps).

When you hold assets at a traditional financial institution, like a bank or broker, you entrust them with your private information and rely on them to keep your funds safe. They may also charge fees for their services.

Kasyno HotSlots promocje i bonusy Listopad 2024 Jeśli uda nam

BUY Penegra ONLINE – CLICKE HERE – FOR PHARMACY ONLINE

ððððððððððððððððððððð The In

Chez Nerdy Peluche, nous comprenons que vous vouliez recevoir votre commande rapidement. C'est pourquoi nous expédions toutes les commandes dans les 72 heures suivant la confirmation de paiement.

Nous offrons la livraison gratuite pour toute commande de plus de 30€.

Tous nos avis sont collectés par une plateforme tierce indépendante, garantissant leur véracité et leur impartialité.

Notre équipe de service client est là pour vous aider à chaque étape de votre expérience d'achat. Nous sommes disponibles 24/7.

Restez à jour avec les dernières actualités de Nerdy Peluche en vous abonnant à notre newsletter. Vous y trouverez une mine d’informations utiles ainsi que des bons plans intéressants pour satisfaire votre passion pour les peluches geek !

Nerdy Peluche c’est LA boutique en ligne spécialisée dans la vente de peluches pour les geeks et les passionnés de la culture pop. Nous proposons une large gamme de peluches inspirées de personnages de films, de séries TV, de jeux vidéo, de mangas et bien plus encore. Tous nos produits sont de qualité supérieure et sont conçus pour satisfaire les fans les plus exigeants.